Assignment: Oligopoly and Monopolistically Competitive Firms

Student Name:

In this Assignment, you will compute total cost, total revenue, and total profit/loss. Based on the computed results, you will determine the optimal quantity of output, which minimizes loss under a monopolistically competitive market. In addition, you will also evaluate the marketing strategies of oligopoly market firms.

Instructions: Answer all of the following questions. You are required to follow proper APA format. Read the Criteria section below for more information before you begin this Assignment.

Sample paper

Oligopoly and Monopolistically Competitive Firms

Question 1

Do the firms in an oligopoly act independently or interdependently?

They act interdependently. In an oligopoly, there are a small number of producers (Tucker,2010). Firms in such a market prefer learning about the actions of their rivals. As such, they may engage in collusion or form cartels that control prices. The firms can easily network since they are only few in the market.

Question 2

A monopolistically competitive firm has the following demand and cost structure in the short run.

Output Price FC VC TC TR Profit/Loss

0 $90 $90 $ 0 ___$90_ __$0__ __$(90)______

1 80 _$90___ 40 __$130__ __$80_ __$(50)______

2 70 __$90__ 80 ___$170_ __$140__ __$(30)_____

3 60 __$90__ 140 ___$230_ __$180__ __$(50)______

4 50 ___$90_ 220 ___$310_ __$200__ ___$(110)_____

5 40 ___$90_ 320 ___$410_ $200 ___$(210)_____

6 30 ___$90_ 440 __$530 _$180_ ___$(350)_____

7 20 __$90__ 580 __ $670__ __$140__ ___$(530)___

a. Complete the table.

b. What level of output maximizes profit or minimizes loss?

The level of output that minimizes loss is at 2 units. At this level of output, the loss incurred is $30.

c. Should this firm operate or shut down in the short run? Why?

Although the firm is not making any profits, it should not shut down in the short run. This is because since the firm is a monopoly, it can be able to raise its prices and make profits (Tucker, 2010).

Question 3

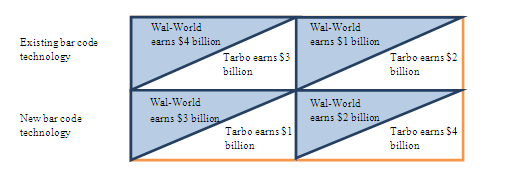

Suppose that Wal-World and Tarbo are independently deciding whether to implement a new bar code technology or use the existing bar code. It is less costly for their suppliers to use one system and the following payoff matrix shows the profits per year for each company resulting from the interaction of their strategies.

-

Does Wal-World have a dominant strategy? Briefly explain.

A dominant strategy may exist when the payoff for wal-World yields the greatest results regardless of other strategies chosen by the other player. Such a condition indicates existence of a dominant strategy (Carmona, 2013). Wal-World lacks a dominant strategy. This is because if Tarbo applies the existing bar code technology ($2>$1), wal-World could opt to do the same in order to get higher profits ($4>$3)

-

Does Tarbo have a dominant strategy? Briefly explain.

Tarbo also lacks a dominant strategy. This is because if it opts for the new bar code technology ($4>$2), Wal-World would opt for ($3>$1) since this would give it higher revenues.

-

Is there a Nash Equilibrium in this game? Briefly explain.

There is no Nash Equilibria. This is because both of the firms lack a dominant strategy. In other words, no firm would wish to choose the point taken by another since it would be disadvantageous in some way.