Question

Term Paper:

– Provide a description of the company that you work for. As part of your description

include a discussion of the type of organizational structure.

– Describe an agency problem within the firm and discuss what you think is causing the problem and how the problem might be better controlled.

– Describe the job dimensions of the firm and discuss whether or not you believe the

current design is appropriate for the firm.

Discuss any suggestions you might have for improving the job design; for example grouped by function or by product or geography or a matrix organization? Provide a diagram if helpful to illustrate. Is this organization

effective?

– Describe the compensation package for executives and employees within the firm.

– Discuss whether or not you believe that the compensation package is effective and any suggestions that you might have for improving the compensation package.

Sample paper

Frontier Communications

Frontier Communications is one of the largest telecommunication firms in the United States. The firm commenced operations in 1935 and has been operating since then. Over the years, the firm has expanded in size, scope, and complexity. The various groups of people within the firm are critical in ensuring its continuity. The three major groups comprise of the management, employees, and the owners. The management acts on behalf of the owners in running the firm. The management is responsible for making day-to-day decisions that significantly affect the financial status of the firm. This gives rise to an agency relationship between the owners/shareholders and the management. The management should act in the best interest of the shareholders while running the firm. Employees play a critical role in executing various tasks within the organization. The employees interact with customers and determine the customer experiences. This paper is an evaluation of the various factors influencing Frontier Communications’ current and future financial position.

Company Description and Organizational Structure

Company Description

Frontier Communications (“Frontier”) is a telecommunications company headquartered in Connecticut, United States. The company provides internet, phone, and TV services to customers across 29 states. The company targets both business and individual customers. The company has 22,700 employees serving about 4.9 million customers (Frontier Communications, 2017). Founded in 1935 in Minneapolis, the company significantly expanded operations from the 1950s to the 1970s, spreading operations to most parts of the U.S. From the 1990s, the company’s management engaged in another expansion drive through multiple acquisitions. The company has made dozens of telephone line acquisitions from the 1990s to the present, making it one of the dominant players in the telecommunications market. The company has had a change of names following acquisitions and restructuring. Prior to 2000, the company was known as Citizens Utilities Company (Frontier Communications, 2017). In May 2000, the company changed its name to Citizens Communications Company, and to Frontier Communications Corporation in 2008.

Organizational Structure

Frontier maintains a functional organizational structure. In this structure, the organizational leadership is structured around the basic organizational functions such as marketing, finance, human resource, operations, and other core functions (Gaspar, 2007). A hierarchical relationship exists among members in the organization. The hierarchical relationship determines the promotional pathways of employees, their roles, and the authority that each holds. Under each segment of the company, employees accomplish specific roles that are different from those in other segments (Gaspar, 2007). For instance, the HR will only deal with employee matters such as recruitment, training, and employee development. Centralization of task coordination is another key feature under the functional organizational structure. A central point of command provides the coordination in the entire organization.

Under the functional organizational structure, the CEO and Board of Directors are at the helm of the company. Below the CEO and the Board of Directors are the major segments of the company. These are human resource, finance, information technology, commercial sales, consumer sales, field operations, operational transformation, legal and secretary, government and regulatory, and media and brand segments. An executive vice president heads each of the major segments. Some of these segments have a number of sub-segments headed by respective vice presidents. The reporting pathways follow the functional model. For instance, under Consumer Sales, Marketing and Product segment there is Marketing Department. The Vice President, Marketing, reports to the Executive Vice President, Consumer Sales, Marketing and Product segment. The Executive Vice President is answerable to the Chief Executive Officer (CEO).

Agency Problem within Frontier

Agency problems are common in all organizations, Frontier being no exceptional. Agency problems arise when there is a divergence of interests between the management and the owners or shareholders (Khan & Jain, 2004). In corporate enterprises, there is a clear separation of power and autonomy in running the affairs of the organization. The owners appoint the management to act on their behalf. As such, management’s most vital goal is to maximize shareholder value. Nevertheless, the owners/shareholders hold little power over the running of the firm. This is because like in the case of Frontier, the shareholders are poorly organized and scattered across the country (Khan & Jain, 2004). It becomes difficult for the shareholders to exercise direct control over the running of the firm. The lack of direct control creates a perceptual vacuum that the management may utilize for selfish interests, instead of pursuing the primary goal which is to maximize shareholder value. This leads to an agency problem between the owners/shareholders and the management.

Frontier management has experienced an agency problem between the shareholders and the management. In 2017, some concerned shareholders filed a class action lawsuit against Frontier’s management. The class action lawsuit involves all interested individuals who purchased the firm’s securities between April 2016 and May 2017. Frontier shareholders (plaintiff) allege that the firm’s management failed to make material disclosures in the financial statements, leading them to make wrong investment decisions. In particular, the shareholders allege that the firm’s management failed to disclose the partial acquisition of Verizon Communications, Inc. (“Verizon”), and including debts accounts that would materially affect the firm’s financial position. The non-paying accounts from Verizon have forced the firm to write-off significant amount of receivables.

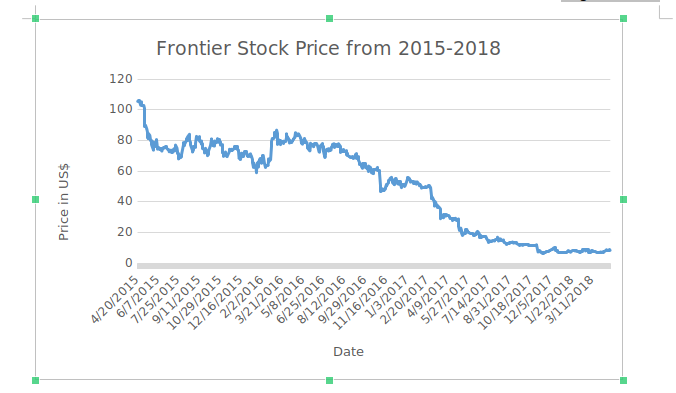

Following the partial acquisition of Verizon, Frontier has experienced consecutive losses over the two-year period. In the first quarter of 2016, Verizon announced a $186 million loss, representing $0.16 loss per share (Frontier Communications, 2016). This was an increase compared to the $103 million loss incurred in the fourth quarter of 2015. The firm’s management attributed the higher loss to Verizon’s partial acquisition, which had a combined impact of $200 million. The combined impact of the loss per share was $0.17 per share (Frontier Communications, 2016). Throughout 2016 and 2017 operational period, the company has continued to experience losses in each of the financial quarter. The management attributes the loss to the non-paying accounts from Verizon and the cost of settling debts. Most of the nonpaying accounts are in California, Texas, and Florida segments. The company has embarked on disconnecting the nonpaying accounts in a bid to reverse the current situation. The following stock chart explains the declining stock prices over a three-year period.

Fig. 1.1. Frontier Communications Stock Price, 2015 – 2018

The issue causing the agency problem is the negative impact of Verizon acquisition to Frontier’s shareholders. The reduced shareholder value has raised serious questions among shareholders concerning management decisions in acquiring the nonpaying accounts. In the last two years, shareholders have not received any dividends due to reduced profits. In 2017, the firm’s management opted to clear debts rather pay dividends in an effort to reduce the high debts and accumulating interests. These decisions have had a negative impact on shareholders who besides not receiving dividends have experienced a decline in stock value, causing further loss. Frontier’s stock has declined in value from 2015 to 2017. In the current year, however, things seem to be looking up for the shareholders as the stock price has begun rising.

Related: Business Ethics Paper

It is possible to resolve the agency problem through various ways. The first way is by shareholders exercising their voting rights or influence over the running of the firm. Institutional investors may have greater power and influence in the company. Institutional investors can forward their complaints to the Board of directors concerning poor decisions by the management (Madura, 2009). The Board of Directors may in turn demand for better management, or in worst case, demand for the removal of the top management. Another way to control this problem is by tying management compensation to the firm performance through stock plans (Khan & Jain, 2004). This allows the top management to acquire stocks at a subsidized price. This motivates the management to take care of shareholders’ interests since higher share prices and dividends means the management will receive higher returns in addition to their salaries.

Job Dimensions of the Firm

Job dimensions influence the motivational potential derived from a particular job. There are five key job dimensions. The first dimension is skill variety (Daft, 2011). Skill variety refers to the distinctiveness of the activities that make up a particular job and the variety of skills applied in performing the job. A job that involves repletion of similar tasks provides low variety. On the other hand, a job where the employee solves new challenges on a daily basis provides high skill variety. Majority of the jobs at Frontier provides employees with higher skill variety. For instance, majority of the engineering and technology jobs provides employees with new challenges on a constant basis. The second job dimension is task significance (Daft, 2011). Task significance is the relevance of the work in the eyes of the firm’s management or consumers. There is high task significance since communication plays a critical role in the eyes of the customers.

The third job dimension is task identity (Daft, 2011). Task identity refers to the extent to which it is possible to trace a particular employee’s effort from the beginning to the completion of a certain task. Some jobs at Frontier have low task identify while others have higher task identity. For instance, most technicians enjoy high task identity since they mostly work on a particular project from the beginning to the end. The fourth dimension is autonomy, which relates to the level of freedom that an employee has in making important decisions (Daft, 2011). Employees at the firm enjoy relatively higher degree of autonomy. For instance, a technician will decide how to complete various tasks such as laying of cables. The last job dimension is feedback (Daft, 2011). This refers to the extent to which one’s effort in completing a job is recognizable by the management. Various tasks have high feedback since at the end of each project, the management can reflect on the success or failure.

Most employees at Frontier feel satisfied with their jobs. Workers who feel satisfied about their job are likely to perform better due to high internal motivation. Jobs should be motivating, interesting, and meaningful to the employees. This is likely to increase productivity and reduce turnover rates. High employee turnover can lead to high costs of replacing the employees who are exiting the firm. It is important for the management to give attention to detail on matters concerning employee needs. Failure to give attention can lead to employee dissatisfaction or low motivation. In the recent period, employees at Frontier have expressed concerns over rising job insecurity. This is because of prolonged period of loss, creating fears that the management may lay off employees in order to reduce labor overheads.

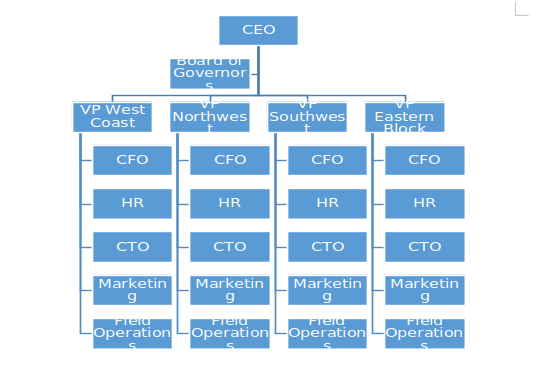

The current design for Frontier serves the company well. At the top, there is the CEO and the Board of Directors. Below the top leadership, there are executive vice presidents for various segments. Below the executive vice presidents are the senior vice presidents. A better design for the company would be one based on the geographical areas of operation. Each division acts like a separate company in that it possesses all the necessary resources to support a particular geographical region. These resources could be technological resources, human resources, capital, and other critical resources. Geographical divisions are particularly useful where the different geographical segments respond to the product in unique ways due to the differences in customer tastes and preferences. Geographical divisions can allow the company to respond to the unique needs of the customers in a particular region.

There exists a high disparity in high-speed internet access between the rural and urban areas. According to Jurney (2015), Arizona had the highest disparities in broadband access between those in urban and rural areas. There are different rates of internet usage among various ethnic groups in the U.S. A study conducted in 2012 indicated that whites had the highest rates of internet usage in 2012 at 77 percent followed by blacks at 66 percent (Kamalu, 2012). Hispanics came third at 65 percent. Another key factor that affects internet usage is age. A geographical organization structure can help in addressing some of the challenges relating to internet coverage. For instance, a geographical division covering a low-income area would be in a better position to introduce a competitive internet package that most residents can afford. The following is the proposed structure for the firm based on geographical segmentation.

Fig. 1.2. Frontier Communications Geographical Organizational Structure

Compensation Package for Executives and Employees

Frontier’s compensation program has unique characteristics. The compensation program embraces pay-for-performance where about 80 percent of the top executives’ pay remains at risk (“Frontier Proxy,” 2017). Pay is also based on long-term incentive awards. This involves tying a part of the compensation to the stock performance. The company employs multipliers in compensating the top executives during periods when the company has surpassed the revenue targets. Frontier executives are required to own stocks amounting to a certain multiplier of their base salary. For instance, the CEO must own stocks five times his base salary. A “clawback” policy exists where the owners may recover some cash paid out to executives who commit a misconduct that significantly affects the financial position of the company.

In 2017, the CEO Daniel J. McCarthy received a $1,000,000 salary. The CEO was also set to receive other bonuses and commissions based on the Frontier’s performance. The bonus and commissions include a transaction bonus, cash incentive bonus, performance shares earnings, restricted stock awards, and other earnings. The 2017 realized pay amounted to $3,091,667 (“Frontier Proxy,” 2017). This was inclusive of restricted stock awards and performance shares. The CEO did not receive transaction bonus nor the actual cash incentive bonus. Named Executive Officers earned an average basic salary of $500,000. The Named Executive Officers also received performance shares and restricted stock awards. The total pay amounted to an average $729,034 (“Frontier Proxy,” 2017). The total compensation package has reduced over the last three years due to declining performance. For instance, the CEO earned a total compensation package of $5,118,891 in 2015.

Related: Advantage and Disadvantage of ex ante analysis and ex post analysis

Fig. 1.3. Named Executive Officers Compensation Package (2017)

| Base Salary ($) | Transaction Bonus ($) | Cash Incentive Bonus ($) | Stock Awards ($) | Performance Shares ($) | Other Compensation ($) | Total ($) | |

| Daniel J. McCarthy | 1,000,000 | – | – | 1,679,173 | 378,313 | 34,181 | 3,091,667 |

| R. Perley McBride | 650,000 | – | – | 16,717 | – | 17,521 | 684,238 |

| Kenneth W. Arndt | 500,000 | – | – | 171,348 | 47,416 | 10,270 | 729,034 |

| Steve Gable | 470,000 | – | – | 125,775 | 17,656 | 9,717 | 623,148 |

| John L. Lass | 439,875 | – | – | 210,039 | 47,416 | 56,756 | 754,086 |

(“Frontier Proxy,” 2017).

Executive vice presidents earned an average $2,500,000 in 2016. The employees, excluding the CEO, had a median salary of $101,408 in 2017. The ratio of the CEO to employee salary (including executives) was 60:1 (“Frontier Proxy,” 2017). Employees in the lower organizational hierarchies enjoy industry-average pay rates. Technical support workers receive $13.55 per hour, call center representative $12.61 per hour, desktop support technicians $14.52 per hour, customer service representatives $13.26 per hour (“Frontier Proxy,” 2017). This information indicates that in most of the jobs, employees receive an above-industry average pay. This can explain the low number of employee strikes has witnessed over the past. Employees also receive other benefits such as dental insurance, life insurance, employee discounts, vision insurance, health insurance, and 401K plans.

Effectiveness of the Compensation Package

Frontier’s compensation package is effective. The compensation package for the lower level employees is either at par or above industry average. This means that most of the employees are satisfied with their pay. Although remuneration may not cause job satisfaction, poor pay can lead to job dissatisfaction among employees. This is because wages and salaries fall under the hygiene factors in Hertzberg’s duo factor theory (Son, Lu, & Kim, 2015). Other hygiene factors are the physical working conditions, fringe benefits, job security, status, interpersonal relations, and among others. The above-industry average remuneration provided by Frontier helps avoid job dissatisfaction among the various employees. The compensation package includes attractive benefits, which also help in reducing job dissatisfaction. The benefits include health and life insurance, which are key considerations to most employees.

The compensation package for the executives in Frontier is also effective. The compensation is effective because executives receive a base pay and bonuses based on the company’s financial performance. Such a compensation package is likely to motivate the executives to make the right decisions since their pay partly depends on performance. The executive package is determined basing on certain key metrics, the major being performance and achievement of certain company and individual goals. The other metric is the hiring of talented executives. The compensation package must be attractive for Frontier to attract and retain highly qualified top leadership. Another metric taken into consideration is the effort made by the executives to give shareholders high return. This is accomplished by basing part of the executive compensation on stockholder return. The assumption is that the executive finds a compelling reason to aim for high shareholder return by being beneficiaries too.

In summary, Frontier Communications is among the top telecommunication giants in the U.S. The firm’s leadership has established a functional organizational structure. In a functional structure, the organizational leadership is structured around the basic organizational functions such as marketing, finance, human resource, operations, and other core functions. The agency problem facing Frontier involves the shareholders/owners and the management. Certain management decisions such as taking excessive debt has had a negative impact on shareholders’ stock value and earnings. Employees at Frontier have high motivation judging by the applicability of the various job dimensions. Lastly, the compensation package for both executives and employees seem appropriate in providing the desired motivation to further the interests of the owners/shareholders.

References

Daft, R. L. (2011). Understanding management. Mason, OH: South-Western Cengage Learning

Frontier Communications. (2016). Frontier Communications Reports 2016 First Quarter Results. Retrieved from http://investor.frontier.com/news-releases/news-release-details/frontier- communications-reports-2016-first-quarter-results

Frontier Communications. (2017). Annual report.

Frontier Proxy. (2017). 2017 Summary Annual Report and Proxy Statement. Retrieved from http://investor.frontier.com/static-files/6135c060-3438-44e6-9822-0c7bb03f98a0

Frontier. (n.d). The official board. Retrieved from https://www.theofficialboard.com/org- chart/frontier

Gaspar, J. E. (2007). Introduction to business. Princeton, N.J: Recording for the Blind & Dyslexic.

Jurney, C. (2015, June 9). Maps show which Americans have broadband access and which don’t. Forbes. Retrieved from https://www.forbes.com/sites/corinnejurney/2015/06/09/maps- show-which-americans-have-broadband-access-and-which-dont/#18dba77f36a0

Kamalu, N. C. (2012). Internet use among racial/ethnic groups in the United States. Government and History Faculty Working Papers.

Khan, M. Y., & Jain, P. K. (2004). Financial management. New Delhi: Tata McGraw-Hill.

Madura, J. (2009). International financial management. Mason, OH: South-Western/Cengage Learning.

Son, M., Lu, C., & Kim, M. (2015). Determinants of post-purchase attitude for social commerce users purchasing food service: A two-factor theory perspective. International Information Institute (Tokyo). Information, 18(1), 149

Related: