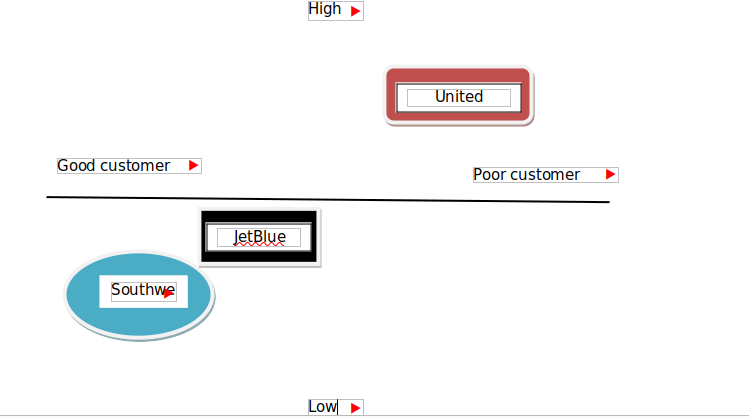

Product positioning map and analysis: Cost and customer service

Southwest Airlines prides itself as a low cost carrier. From the product positioning map above, it is possible to identify that the airline positions itself as a non-frill carrier and thus lowest flight costs in the industry. The airline provides point-to-point flights to customers, delivering customers to various destinations in a convenient and faster way (‘Southwest,’ 2015). The no-frill service has been essential in filling a market niche that existed in the U.S. airline industry. Point-to-point service has enabled the airline to record the highest turnover rates of flight services, thus saving the airline costs. The airline uses one type of fleet – the Boeing 736 which significantly reduces operational costs. For instance, the airline does not need to train pilots and mechanics to handle different types of fleet (‘Southwest,’ 2015).

Related: Southwest Airlines Strategic Management Phase 1

According to recent rankings, Southwest Airlines has risen in terms of quality of customer service, earning its position among the top best airlines in terms of customer service. The survey, published in FORTUNE magazine, listed Southwest Airlines in second position terms of customer satisfaction in 2015 (‘FORTUNE,’ 2015). The airline was listed second to JetBlue Airlines which took the first position. United Airlines had a low figure indicating poor customer service. The survey also indicated a 3% increase in the overall customer satisfaction in the travel industry. Customer satisfaction in the service industry plays a major role in attracting and retaining customers. Poor customer services ultimately leads to collapse of a service-oriented business such as the aviation industry.

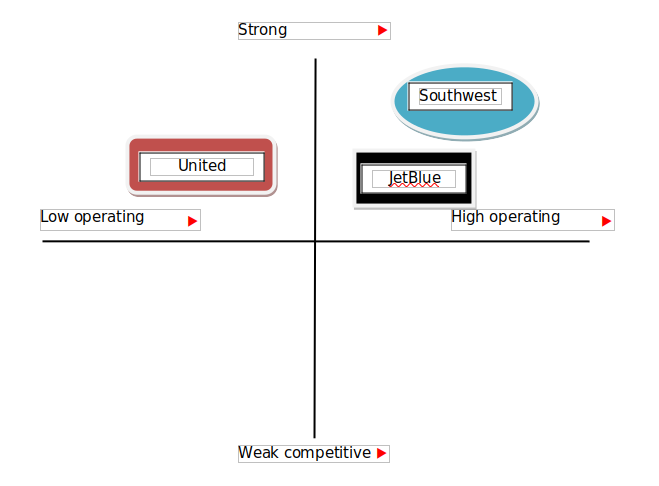

Product positioning map and analysis: Competitiveness and operating efficiency

Southwest Airlines has a strong competitive edge in the airline industry. The airline has profitably operated for over 40 years in the aviation sector, even during the 2008/2009 recession when some of the airlines made huge losses. Southwest Airlines has managed to create a strong competitive advantage owing to its unique services that target unexploited gaps in the market. In addition, the airline provides most of its services in a different manner from the rest of the airlines in the business. United Airlines records the lowest operating efficiency (Trefis, 2015). According to Porter (1996), strategy revolves all around doing things in a different manner from the rest of the competition. This is what creates a sustainable advantage over other businesses. Southwest Airlines has managed to create a competitive edge by being unique in its provision of services. The airline has the quickest turnaround time, on average 15 minutes. This ensures most of its planes fly for longer compared to rivals. The airline does not provide meals, no first class services and seating is open. In addition, the airline encourages customers to book at the point of departure by issuing automatic tickets to eliminate the higher fees incurred when customers book via travel agents. Using one type of aircraft has also enabled the airline to reduce maintenance and purchase costs (‘Southwest,’ 2015).

Read also: EFE and CPM Matrix for Disney Parks and Resorts

Southwest Airlines has maintained a strong operating efficiency compare with its competitors. Operational efficiency involves a combination of the best prices, simplicity in use and high quality all geared towards the customers. Delivering higher value to customers results to increased revenue. Companies with high operational efficiency record low unit costs, making them more profitable. Southwest airlines targets price-sensitive clients who would otherwise use alternative means such as cars, trains and buses. The airlines’ frequent departures in addition to low fares attract customers in the price-sensitive bracket. Point-to-point services have also enabled the airline to achieve a quick turnaround time thus fully utilizing all the resources.

Evaluation of strategies and objectives to achieve most favorable market position

Expansion into the international market

The expansion in the domestic market has already reached saturation. Southwest Airlines cannot expand more as it is already in the maturity stage. The only alternative would be to exploit the international market where opportunities are large. According to McCartney (2015), international flights are on the verge of a great revolution that is similar to the one experienced in 1990s when domestic flying became common and cheaper. This was primarily driven by entrance of low cost carriers and increased number of flights between secondary airports. Statistics from Bush International indicate that in 2014, international passengers increased by 9%, compared to a paltry 2% for domestic passengers (McCartney, 2015). The international market thus presents great potential for huge returns. Majority of airlines that traditionally offered domestic flights are aggressively turning towards the international market. For instance, JetBlue, one of Southwest’s greatest competitors have expanded operations to Fort Lauderdale, Houston, among other areas. This has brought the need for Southwest Airlines to expand operations to international market if it seeks to remain in a favorable market position.

Increasing employee morale

Even though international operations come as a major opportunity for growth, challenges still loom. Majority of the employees feel discontent with the compensation they receive for the additional mileage covered in international flights (Carey, 2014). Southwest Airlines does not pay extra salaries to employees on international flights, who have to work for longer hours. Majority of the airline’s employees are unionized and this might result to labor strife between the employees and the airline’s management. Employees expect to receive more compensation while on international flights. Nonetheless, the management is reluctant to increase their salaries arguing that Southwest employees are the best paid in the U.S. industry (Carey, 2014).

Cost effective strategy

In order to achieve a favorable market position, Southwest Airlines must continue operating as a low cost carrier, while providing quality services compared to rivals (Bhaskara, 2014). The cost leadership strategy has enabled the carrier to remain the favorite airline option especially to the price sensitive consumers who form the majority of passengers in the U.S. The airline is particularly favorable to small business travelers and leisure customers. Southwest Airlines mostly offers connectivity to secondary airports within the U.S. Tourists often prefer the airline as it offers connectivity to secondary airports as well as the low freight charges. The no-frills policy has enabled the airline to operate at minimal costs, and hence reduced fares. Most of the airlines’ destinations take less than 2 hours on average. This has enabled the airline to operate on a no-frill policy without losing customers to its rivals (Bhaskara, 2014).

Acquisitions

Southwest Airlines can maximize profitability by making acquisitions. Acquisitions will enable the airline expand quickly into new markets by taking over the markets controlled by the acquired firms. In 2012, the airline acquired AirTran and was able to expand its scope of flight operations in airports where it formerly controlled only a few slots. For instance, the acquisition of AirTran gave Southwest Airlines the opportunity to acquire more slots at Ronal Reagan and LaGuardia airports. In addition, it enabled the airline to commence operations at Hartsfield Jackson Atlanta airport (Diaz, 2012).

Customer lock-in

Southwest Airlines enjoys a relatively huge market share. The airline should aim at ensuring that these customers do not opt for rival airlines. This can be achieved by ensuring that there is an attractive reward or points program that entices customers to use the airline at all times. Southwest Airlines should strengthen the existing reward programs. For instance, the airline can increase the share of reward points a customer gets when traveling with Southwest Airlines.

Introduction of premium services

In order to achieve a favorable market position, Southwest Airlines must ensure that customers get value for their money. Employees at Southwest must treat customers with dignity and respect in order to win their loyalty. Over the years, the airline has managed to hold a high record in terms of customer satisfaction, coming second in a recent survey to JetBlue. Motivating employees is critical in ensuring they deliver their best to customers. Southwest Airlines has the best paid employees in the industry. In addition, the employees have a high degree of freedom, with majority being unionized (Bhaskara, 2014). To accord more comfort to customers during flights, the airline should introduce premium seats on each of its flights that offer more legroom. Currently, customers who require more legroom are required to make their bookings early. In addition, the airline should introduce meals which customers can purchase especially during long flights.

Since 2000, Southwest Airlines major appeal has been the small business travelers and tourists. However, stagnation in terms of growth in the sector has forced the airline to widen its net to corporate customers. The airline has introduced a number of measures aimed at attracting high end customers. For instance, it launched a business select product that gives customers priority boarding depending on arrival time. Other products include WiFi, selective boarding based on arrival time and liveTV all which are tailored to suit business travelers (‘Business Select’, 2015). With the introduction of international flights, the airline must add premium services so as to attract customers. Market survey indicates that most people prefer premium services when flying for long hours.

Description of how you would implement the strategies

Strategic issue: Overseas flights

Expanding operations into the international market may take time and often require huge capital investment. The first step would be to acquire the necessary technology that would enable the airline operate on an international scale. Southwest Airlines’ reservation system has been tailored for the domestic market. This means that it could not be used to handle international bookings. Secondly, acquisition of a code sharing software would be vital to ensure that the airline can exchange reservations with other airlines in international flights. Overseas expansion also requires training of all employees on how to handle international flights. For instance, employees must be taught on how to interact with flight controllers who may be speaking accented English (Carey, 2014).

Related: Southwest airlines Strategic management Phase 2 Case study

Southwest Airlines should offer international flights to destinations such as Mexico City, Costa Rica, Dominican Republic and other popular oversea tourist destinations. Currently, the airlines presence in international destinations accounts for a paltry 2%, with 98% of flights concentrated to domestic markets. Southwest Airlines should increase flights to international destinations to reach a 10% to 15% presence in international markets over the next 5 years (‘Centre for Aviation,’ 2015). In order to avoid making losses through introduction of overseas flights, Southwest Airlines should carefully role out the service. Some of the most favorable international destinations the airline should start with include Mexico City, Belize City, Costa Rica, Puerto Vallarta among others. A possible expansion plan is to commence weekly flights every month to an identified destination. The weekly flights can enable the management decide whether to increase the number of flights in a given route or whether to do away with it.

Strategic issue: Increasing employee morale

Southwest Airlines is committed to ensuring a positive attitude among employees towards work and the company. This can be achieved by providing a good work environment in terms of compensation, providing opportunities for growth and encouraging innovation and creativity in the workplace. In addition, the management must treat the employees with respect, dignity, caring attitude and concern which they are also expected to extend while serving customers. Since majority of the employees are unionized, the management should consider renegotiating payment terms especially with employees engaged in international flights. Allotment of employees to international flights should be based on merit, or as a reward to best employees. A 10% increase in salary to be affected by 1st December 2015 to all employees flying to international destinations. Based on the current salaries, this would translate to $ 1174.96 per employee. Although this will lead to a small decrease in profit margin, it will greatly improve employee morale and avoid impending labor issues. Moreover, the cost increments are insignificant compared to expected returns from international flights.

Strategic issue: target more premium customers

Even though Southwest Airlines targets premium customers under its Business Select program, more still needs to be done to attract more of these customers who often opt for rival airlines especially during long flights. The program ensures consumers enjoy the A1-15 boarding position based on whoever boards first. Customers also enjoy a premium drink and extra points (‘Southwest,’ 2015). In order to attract more premium customers, the airline should drastically upgrade all the in-flight conditions. More meal options should be made available to give customers variety and a wider choice. Free WiFi services should also be extended on all planes. Currently, individuals must pay $8 to access WiFi on planes that are WiFi enabled (‘Southwest,’ 2015). The airline can also provide free in-flight movies to premium customers. Premium services can be rolled out on select destinations only to avoid high costs, more so destinations with high number of business travelers. Such routes include Toronto, Mexico City, Las Vegas, New York City, among others. This can attract new customers who often use rival airlines such as JetBlue that offer first class services. Introduction of premium services should be affected in early 2016.

Strategic issue: Acquisitions and mergers

Acquisitions and mergers are often costly and require long-term planning. Nonetheless, they can enable Southwest Airlines to easily expand overseas. For instance, Southwest’s acquisition of AirTran has given it access to over 21 more destinations, seven of these being overseas destinations (Carey, 2015). The acquisition has enabled Southwest Airlines to stamp its presence firmly in South as well as Central America, destinations that were formerly dominated by AirTran. The most suitable merger partner for Southwest Airlines would be Alaska Air. This is because the airline has a similar structure to Southwest – majority of its planes are the Boeing-737 (Levine-Weinberg, 2015). This means that Southwest would easily be able to integrate its operations with those of Alaska Air. Other airlines such as Hawaiian and JetBlue operate mixed fleet hence it may be costly to merge. Acquiring Alaska Air would enable Southwest Airlines to penetrate international markets and consolidate local destinations, for example Seattle where Alaska Air has a huge presence. The next merger or acquisition should be conducted in late 2016. This is appropriate so as to give the airline time to recoup some profit from the AirTran merger in 2011.

Specific results to be achieved including market, financial, and product or service goals

Larger market share

Southwest Airlines had little opportunities for growth in the domestic market. This leaves overseas expansion as the only viable alternative for growth. Current projections indicate that the airline can easily achieve 10% to 15% market dominance in the international market within a span of five years (Levine-Weinberg, 2015). One of the strategies that the airline has put in place to achieve a larger market share is acquisition and mergers. Through the strategies, the company will be able to quickly enter new international markets. For instance, if the airline successfully acquires Alaska Air, it will be able to add over 30 new routes to booth international as well as domestic destinations. These are the major routes served by Alaska Air such as Mexico, New Mexico, Colorado, Costa Rica, Massachusetts, among others. This means that the airline will be able to offer over 30 new daily flights to international destinations and additional 3000 flights to local destinations.

Increase in employee morale and productivity

Southwest Airlines puts its employees’ welfare in the forefront. The company is dedicated towards ensuring that employees are happy at work so that they can deliver their best to the customers. Increasing salaries will be a way of motivating employees to provide exceptional services to their customers. It will also reduce the dissatisfaction among majority of the employees on international flights who feel they should receive extra compensation. Currently, employees on international flights receive less salary compared to what is paid by other major airlines in the international market. A salary increment will automatically change employees’ attitude especially towards international flights. According to Carey (2014), some employees lack the will to work in international flights owing to lack of interesting pay packs common with other airlines such as JetBlue. A salary increment will reverse this trend and make it easier for the airline to expand operations into the international market.

Large customer base

Introduction of premium services will increase the number of customers using Southwest Airlines. It will enable Southwest Airlines to compete effectively in routes where other airlines such as JetBlue dominate. Over the recent years, intense competition has seen most airlines copy Southwest Airlines’ low cost business model. In March 2015, JetBlue established a number of point-to-point flights between Lauderdale and Philadelphia, and from Orlando to Baltimore (Levine-Weinberg, 2015). Nonstop flights are usually common to Southwest Airlines. To avoid losing its share of the market to new rivals, Southwest Airlines must continue to develop new products. Introduction of premium services will be a better way to counter such competition and to avoid rivals from eroding its customer base.

Financial projection

This section gives a detailed financial forecast for the next five years, including an analysis of current financial position.

Actual (2013 & 2014) and projected (2015 to 2018) Income statement

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| (In Million $) | ||||||

| Sales | 17,699 | 18,605 | 19,600 | 20,800 | 21,781 | 22,791 |

| Gross income | 2,315 | 3,621 | 4,890 | 4,990 | 6,010 | 6,991 |

| Operating profit | 1,448 | 2,388 | 3,866 | 3,930 | 4,219 | 4,819 |

| Net income | 754 | 1,136 | 2,360 | 2,340 | 2,577 | 2,700 |

| Dividends per share ($) | 0.13 | 0.22 | 0.25 | 0.29 | 0.31 | 0.34 |

| Earnings per share ($) | 1.05 | 1.64 | 2.44 | 3.54 | 4.13 | 4.98 |

| Dividend Yield | 0.33% | 0.56% | 0.66% | 0.71% | 0.79% | 0.84% |

Following recent financial trends in the company, sales revenue is expected to continue growing over the next coming years. The increase in sales revenue stems from capacity growth arising from new operations in overseas markets. Part of this growth will also be realized from reduced unit costs, which will be about 1% lower. Reduction in unit costs results from the increased stage lengths as the airline will fly to more international destinations which are far. In the coming years, Southwest Airlines will be able to increase stage length by over 70%. The airlines’ profits will also continue to rise in the coming years. This will mainly be driven by large number of customers in new markets as well as premium customers.

Southwest Airlines records over 100 million passengers a year. This number will increase to over 150 million passengers by 2018, given that its acquisition plans succeed (‘Southwest Corporate Factsheet,’ 2015). Southwest Airlines will achieve a growth of over 120% by 2018 if the current trends continue. This will also result to increase in the stock prices, which will ensure that shareholders get value for their investment. Current projections indicate that stock price may increase by over 60% by 2018, without increasing the P/E to more than 35 (Levine-Weinberg, 2015). Southwest Airlines future outlook seems bright, and the company will most likely continue turning profits over the next five years.

Executive summary

Southwest Airlines is a Texas-based carrier which started operations in 1967. The airline operates as a low-cost model, providing quality services at minimal costs. The airline is the largest in terms of domestic flights in the United States. Since inception, the airline has had a long streak of positive returns attributed to a number of effective strategies put in place by the management. Over the years, the airline has concentrated operations in the domestic market. However due to limited growth opportunities in the domestic market, the airline has disrupted its operations targeting the international market.

Southwest Airlines which largely dominated the domestic market is increasingly facing competition from other airlines such as JetBlue and American Airways. Most of these rivals have copied Southwest Airlines business model such as offering point-to-point flights. In addition, some of the airlines are charging lower fares than Southwest Airlines in some of the routes. This has necessitated the need to establish strategic objectives that will enable Southwest Airlines to compete effectively with other airlines. In order to increase growth, the airline must expand to overseas destinations. Expansion into the international market should be done in piecemeal manner. This will enable the management to test various international destinations before fully commencing operations.

Mergers and acquisitions can help the airline to easily commence operations in the international market. With the introduction of overseas flights, Southwest Airlines must include premium services to attract customers. Employee salaries must be reviewed especially for workers who have to spend long period of time during international flights. In addition, other employees should also be accorded a salary increment to boost their morale and delivery. Salary increment should be taken as a matter of urgency as some employees have already shown discontent especially over pay in international flights. Lastly, Southwest Airlines should maintain its low-cost structure as it is the main attraction to majority of the customers. Thus, management must be keen in implementing the strategies to avoid increasing operational costs by a higher scale.

References

Bhaskara, V. (2014, April 22). Southwest Airlines opens for business-customers. Forbes. http://www.forbes.com/sites/airchive/2014/04/22/southwest-airlines-opens-for-business- customers/

Business Select (2015). Retrieved from https://www.southwest.com/businessselect/

Carey, S. (2014, Oct. 14). Steep learning curve for Southwest Airlines as it flies overseas. The Wall Street Journal. Retrieved from http://www.wsj.com/articles/steep-learning-curve- for-southwest-airlines-as-it-flies-overseas-1413326936

Centre for Aviation (2014). Southwest Airlines adds a new competitive dimension on routes to Mexico and the Caribbean. http://centreforaviation.com/analysis/southwest-airlines-adds- a-new-competitive-dimension-on-routes-to-mexico-and-the-caribbean-176272

Díaz, A. (2012). Southwest Airlines expected to add AirTran flights to Puerto Rico. Caribbean Business, 40(37), 7.

Levine-Weinberg, A. (2015). Attacking Southwest Airlines head-on. The Motley Fool. http://www.fool.com/investing/general/2015/05/20/jetblue-is-attacking-southwest- airlines-head-on.aspx

McCartney, S. (2015, April 8). Why more airports are luring international flights. The Wall Street Journal. Retrieved from http://www.wsj.com/articles/why-more-airports-are- luring-international-flights-1428530496

Porter, E. M. (1996). What is Strategy? Harvard Business Review. Retrieved from https://hbr.org/1996/11/what-is-strategy

Southwest (2015). In the air. https://www.southwest.com/html/customer-service/inflight- experience/index-pol.html

Southwest Corporate Fact Sheet, (2015). Southwest Airlines Newsroom. Retrieved from www.swamedia.com/channels/Corporate-Fact-Sheet/…/corporate-fact-she

Trefis, T. (2015). Airlines in review: American, United, Southwest, Jetblue report operating results for April. Forbes. Retrieved from http://www.forbes.com/sites/greatspeculations/2015/05/13/airlines-in-review-american- united-southwest-jetblue-report-operating-results-for-april/2/