International Economics

Assessment 1:

Note: This is a group assessment. In any group maximum of 3 members are allowed. In mentioned cases provide a neat diagram to explain your answer. Make sure to label axes properly. Else points will be deducted. The maximum possible points is 40.

Maximum points: 40 points

- The following excerpt is from the case study “The Euro in crisis: Decision Time at the European Central Bank”. (distributed in the class)

“……a bailout for Greece would send a signal to other indebted member states that the ECB would step in if private lenders become nervous.”

Answer the following questions with appropriate diagram and using AD-AS model, Money market, aggregate expenditure model, and forex market (as required). For part a, b and c appropriate diagrams are MUST. Else points will be deducted.

Sample paper

When ECB went out for a bail out then what was expected to happen to the interest rate in Greece? (10 points)

At this moment, many European countries were still suffering from the effects of the 2008 economic crises. Greece is one among the many European countries that were in the verge of collapsing considering that it did not have enough funds to run its operations. However, on May 8, 2010, finance ministers of 16 Eurozone nations met in Brussels to discuss on the best way to help Greece out of its current situation back then. After a lengthy discussion, they settled for a bailout. However, this bailout did not come without adverse effect. The decision of the European Central Bank to bailout Greece could have a negative effect on the interest rates in the country. Having a large chunk of money in the economy after the recession would increase the amount in circulation in the economy of Greece and hence lead to an increase in the interest rate of the country (Trumbull, 2010). Having a lot of funds in the circulation would definitely lead to inflation which then would require the banks to raise their interest rates in the attempt to control the inflation in order to feel and see that value of the bailout. Despite the fact that economy cannot run without enough funds, a lot of funds would do more of harm than good. On the same note, if the interest rate of Greece increases, it becomes difficult for people to have access to loans.

Comment on the expected outcome of this policy on behalf of ECB. Provide diagram and detailed explanation on output and prices. (10 points)

Despite the bailout having adverse effects at the European level, the bank itself would be affected in various ways. The primary goal of any bank is to stabilize the prices of goods and services in any country, and the bailout meant that the bank would be going against this principle. Going on with the bailout, meant that the European central bank was not insulated against the political pressure that may be present in the specific countries. Moreover, considering that the European central bank is not directly associated with any specific country, bailing out Greece would have been seen as if the bank was meddling with political independence of members. As a matter of fact, meddling with Greece bailout, it would have prompted other countries such as Spain which was going through the same situation to stake their claim of needing financial assistance from the bank. In general, we can say that although the bailout would have saved Greece from collapsing economically, it would also have triggered other unwanted and adverse effects particularly from political institutions from other countries.

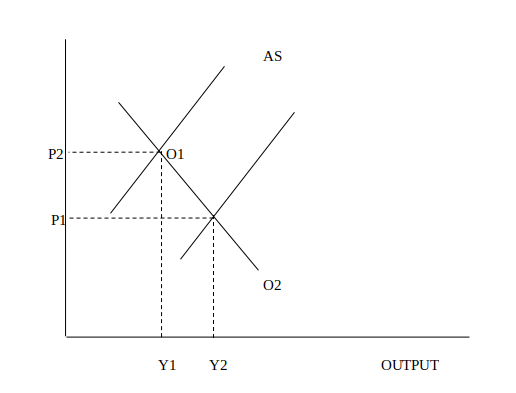

On the same note, the bailout would lead to an increase in the total output of the country considering that Greece will be in a position to produce more. Having enough cash in the economy helps the country to increase its investment opportunities and chances considering that the white collar sector may not be having enough employment opportunities. However, there is always a negative correlation between prices and outcome. An increase in output leads to a decrease in prices of goods and services. Since the output is high and there are many suppliers of the same product, there is no stiff competition for the available goods and services, and this helps to lower the prices of these commodities (Campello, 2010). On the other hand, when the output is low it raises the prices of the commodities and services since all customers would be fighting for the available goods.

From the diagram above, we can see the negative correlation between the prices of commodities and the output of the same in Greece after the bailout is effective. If the prices moves from P1 to P2 the output reduces from Y2 to Y1.

-

c) If government of Greece also increases (assume) the expenditure (expansionary fiscal policy) then what do you think can potentially happen to prices? Provide the relevant diagram and explain your answer.(10 points)

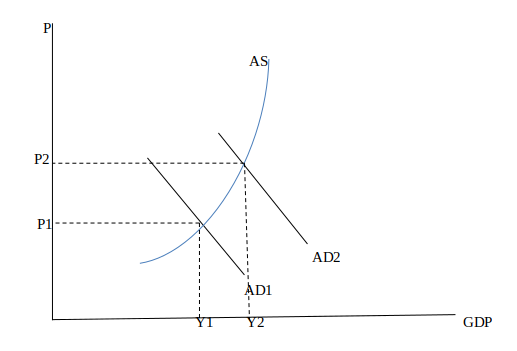

If Greece employs expansionary fiscal policy, the prices will go up. Expansionary fiscal policy involves more government spending which leads to increased aggregate demand. Thus, the chances are that there will be an increase in the amount of money in circulation. This means that most individuals if not all will have money to purchase goods and services at any price thus increase the demand for the available goods and services (Trumbull, 2010). This effect leads to inflation which is the continued and persistent rise in prices of goods and services as a result of higher demand in the economy

An increase in the Greece government expenditure would lead to an increase in the nation income thus an increase in aggregate demand. From the diagram above, it is easy to tell that as the GDP increases from Y1 to Y2 so does the aggregate demand as it moves from AD1 to AD2. This movement in aggregate demand triggers the price to increase from P1 to P2. Considering that citizens have enough money, they will be fighting for the available goods and services regardless of the price.

Overall do you think that bail out of Greece is healthy policy from the perspective of ECB? Answer this one in context of the Case study. ( 5 points)

Yes. The ECB’s main mandate is to protect the value of the euro and extensively the euro itself. Bailing out Greece would have forced the bank to engaged in a fiscal transfer. The formation of the new European Financial Stability Fund (EFSF) demanded support from member states; this support, however, was put to risk by the ECB as its move to bail out Greece risked reducing vital political support for the formation of EFSF.

The main role of the new European Financial Stability Fund is to act as a financial backstop for any Eurozone country that was having troubles accessing the bonds markets. This setup sends a signal to Portugal, Greece, and Spain that the ECB would provide a backstop in case of fiscal crisis.

If Greece were left to default otherwise it would only lead to other low states like Portugal and Spain to follow the same suite, therefore, sending the whole EU spirally into a crisis, the euro would depreciate and thus the overall economic situation of the Eurozone would worsen further. Setting up financial stability through the bail out of Greece and the formation of European Financial Stability Fund is a long-term solution to such contagion. Therefore, the euro value would be protected, and the euro itself defended through the bailout of Greece. The protection of the Euro value is the main objective of the European Central Bank thus bailout of Greece is a healthy policy since it aids the ECB in stabilizing the euro value.

Explain why a group of economist thinks that a common currency like Euro for the region is not a good idea. Restrict your answer to the concepts discussed in the class and the case Study. Page limit is one page. (5 points)

The Euro like any other new idea being brought into existences suffered a number of criticisms that it was not a good idea. Economists such as Milton Friedman, Henry Kaufman, and Martin Feldstein warned that the euro as a single currency could trigger a civil war in Europe. Other Economists emphasized on the risks of centralizing monetary policy to the common decision-maker ECB while fiscal authority was controlled by the member states. These economists alerted that individual states had an incentive to over-stimulate their economies through fiscal imprudence because the benefits of fiscal stimulus were local and the costs of monetary tightening were felt across Europe (Trumbull, 2010). This act would only weigh the ECB to charge higher interest rates than might otherwise be necessary to meet their inflation targets, resulting in slower economic growth across the Eurozone.

References

Campello, M. G. (2010). The real effects of financial constraints: Evidence from a financial crisis. Journal of Financial Economics, 97(3),, 470-487.

Trumbull, J. G. (2010). The Euro in Crisis: Decision Time at the European Central Bank.

Related: